Shareholders Matters

Infratek shall ensure its shareholders long term value creation, which is higher than that of relevant and competing investment alternatives, through operations based on good business practices. For our shareholders, this will consist of the long term price development for Infratek shares in combination with paid dividends.

Shareholders policy and dividends

Concise and effective corporate governance and company management shall contribute to advancing the greatest possible value creation and ensure a high level of confidence in the company’s board of directors and management. Open dialogue with the financial community, equal treatment of shareholders, and timely and comprehensive information about the company’s activities form the basis for a balanced and accurate valuation of the Infratek share.

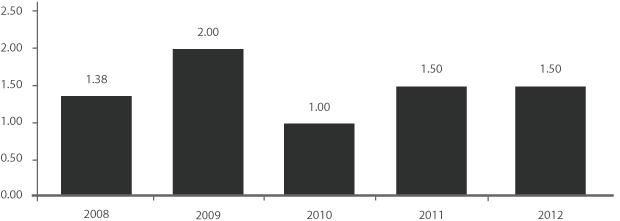

Infratek has a goal to maintain an annual dividend level of 50 percent or more of after-tax profits, adjusted for noncash-generating items. The Board of Directors will consider Infratek’s expansion possibilities, liquidity, and financial position when determining the dividend level.

The Board of Directors will propose to Infratek’s annual general meeting that a per-share dividend of NOK 1.50 be paid for the 2012 accounting year. The dividend represents 135 percent of profit after tax, and the proposal is based on the Groups strong capital structure and expected positive cash flow in 2013.

Dividend per share in NOK

* Dividend for financial year 2012 to be approved by the annual general meeting on 7 May 2013.

Share price development and turnover

The market capitalization of Infratek, based on the year-end 2012 closing price, was NOK 1.2 billion. At year-end 2011, Infratek’s share price was NOK 20.6 compared to NOK 18.6 at the year-end 2012 based on the latest trade share price as of 28 December. In addition, a dividend a per-share of NOK 1.5 was paid during 2012. The highest share price recorded and the lowest share price recorded in 2012 were NOK 23.0 and NOK 16.1, respectively. A total of 4.5 million Infratek shares were traded in 2012, here by 0.7 million traded on Oslo Stock Exchange. Infratek has a market maker agreement with Fondsfinans to ensure adequate liquidity. The Infratek share is classified as OB Match.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||||||

| Highest share price | 20.0 | 22.4 | 17.5 | 26.0 | 24.4 | 23,0 | |||||

| Lowest share price | 17.6 | 13.3 | 11.5 | 15.7 | 18.7 | 16,1 | |||||

| Closing price as of 31 December | 20.0 | 13.5 | 17.0 | 20.8 | 20.6 | 18,6 |

Share capital and shareholder structure

As of 31 December 2012 Infratek’s share capital comprised 63 863 224 shares. The shares have a par value of NOK 5.00 per share. Hafslund ASA is the largest Infratek shareholder, owning 43.3 percent, and Fortum Nordic AB the second largest shareholder with 33.0 percent as of 31 December 2012. There have been no changes in Hafslund or Fortum’s ownership during the year. The remaining largest shareholders are represented by financial investors and nominee accounts. A total of 0.63 percent of the company’s share capital is owned by members of Infratek’s Board of Directors and Group management, and 97.6 percent of the share capital is held by the company’s 20 largest shareholders.

As of 31 December 2012, there were 550 shareholders; 7.4 percent of the company’s shares were held by non-Norwegian shareholders.

Authorisations and voting

The Board of Directors is authorized to acquire up to 6 386 322 new shares equal 10 percent of the company’s share capital. The authorizations are valid until the 2013 annual general meeting. Each Infratek share carries one ordinary vote. The Group has no ownership restrictions, other than as prescribed by Norwegian law. Norwegian corporate law dictates that one may only vote for shares which are registered in one’s own name. Shares falling under custodian registration must thus be re-registered prior to the annual general meeting in order to establish voting rights.

Investor Relations

Shareholders, banks, and the financial market are kept informed about key events through Infratek’s annual and quarterly reports, stock exchange notices, and media releases. Further, Infratek regularly schedules meetings with investors and analysts. Investor-related information is published on Infratek’s website: www.infratek.no.

Share price development and turnover at Oslo børs.

Ownership structure by number of shares held

No. of shares hold |

No. of shareholders |

Proportion of share capital |

Total no. of shares held | |||

| 1 - 100 | 16 | 0.0 % | 567 | |||

| 101 - 1000 | 278 | 0.3 % | 187 704 | |||

| 1001 - 10 000 | 210 | 0,9 % | 547 617 | |||

| 10 001 - 100 000 | 27 | 1.4 % | 882 154 | |||

| 100 000 - 500 000 | 10 | 3.1 % | 2 011 441 | |||

| 500 000 - 99 999 999 | 9 | 94.3 % | 60 233 741 | |||

| 550 | 100.0 % | 63 863 224 |

Infratek’s largest shareholders as of 31 December 2012

# |

Owner |

Number of shares |

Ownership (in %) |

|||

| 1 | HAFSLUND ASA | 27 652 360 | 43.30 % | |||

| 2 | FORTUM NORDIC AB | 21 074 864 | 33.00 % | |||

| 3 | ODIN NORDEN | 3 275 600 | 5.13 % | |||

| 4 | ORKLA ASA | 2 351 044 | 3.68 % | |||

| 5 | NORDSTJERNAN AB | 1 952 067 | 3.06 % | |||

| 6 | THE NORTHERN TRUST C TREATY ACCOUNT | 1 595 600 | 2.50 % | |||

| 7 | SKANDINAVISKA ENSKIL A/C CLIENTS ACCOUNT | 947 100 | 1.48 % | |||

| 8 | MP PENSJON PK | 830 000 | 1.30 % | |||

| 9 | VERDIPAPIRFONDET DNB | 555 106 | 0.87 % | |||

| 10 | VPF NORDEA AVKASTNIN C/O JPMORGAN EUROPE | 312 000 | 0.49 % | |||

| 11 | VJ INVEST AS | 303 456 | 0.48 % | |||

| 12 | VPF NORDEA KAPITAL C/O JPMORGAN EUROPE | 249 850 | 0.39 % | |||

| 13 | TERRA TOTAL VPF | 220 895 | 0.35 % | |||

| 14 | FROGNER BJØRN | 206 000 | 0.32 % | |||

| 15 | IVAR S. LØGE AS | 200 000 | 0.31 % | |||

| 16 | VERDIPAPIRFONDET NOR | 154 000 | 0.24 % | |||

| 17 | VPF NORDEA SMB C/O JPMORGAN EUROPE | 147 340 | 0.23 % | |||

| 18 | POLLENINVEST AS NIL | 115 900 | 0.18 % | |||

| 19 | BANGEN LARS | 102 000 | 0.16 % | |||

| 20 | JPMORGAN CHASE BANK NORDEA TREATY ACCOUN | 98 500 | 0.15 % | |||

| 20 largest shareholders | 62 343 682 | 97.62 % | ||||

| Total | 63 863 224 | 100 % | ||||

| Board and Management* | 405 000 | 0.63 % |

* Does not include shares owned by Fortum Nordic AB and Hafslund ASA where Kristian Rød are employed respectively.

|

Analysts that monitor Infratek

|

||

Carnegie Johan Strøm E-mail: js@carnegie.no Tel: +47 22 00 93 52 / +47 93 40 93 52 |

Fondsfinans ASA Arne Egil Rønning E-mail: aer@fondsfinans.no Tel +47 23 11 30 46 /+ 47 97 74 88 47 |

|

DnB NOR Markets Ole-Andreas Krohn E-mail: ole-andreas.krohn@dnbnor.no Tel: +47 22 94 89 91 / +47 91 85 97 22 |

Investor Relations contact Vibecke Skjolde, CFO E-mail.: vibecke.skjolde@infratek.no Tel: +47 91 66 21 10 |

|

2013 Financial Calendar

First-quarter presentation: 8 May 2013

General meeting: 7 May 2013

- Shares trade ex-dividend: 8 May

- Dividend paid: 31 May